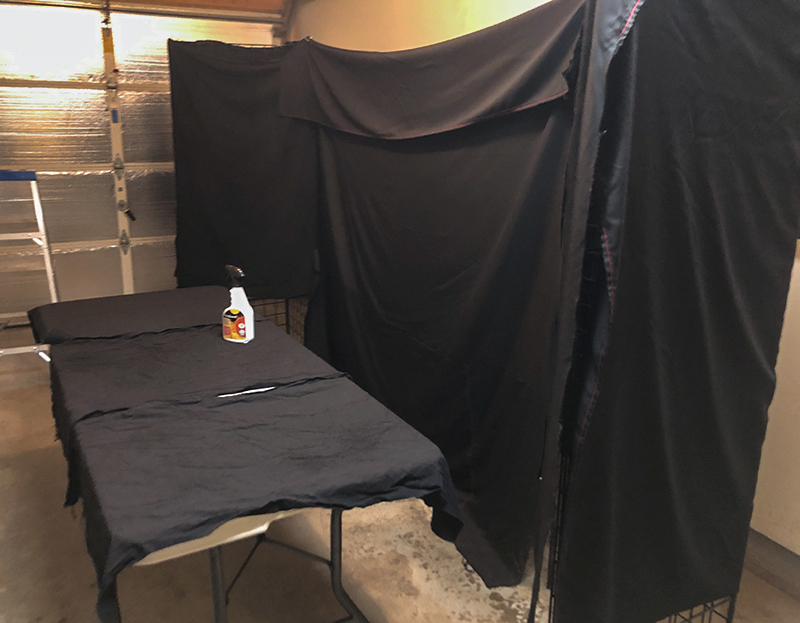

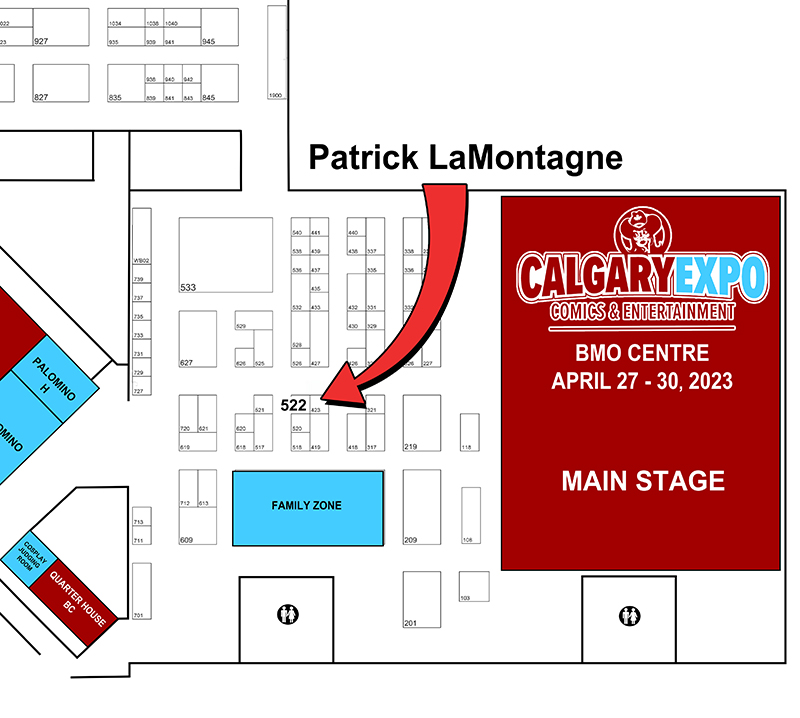

Despite a few last-minute details, I’ve finished most of my prep for the Calgary Expo, including some stranger preparations most people don’t think about, like spraying my tablecloths and grid wall fabric with a fresh treatment of fire retardant. It’s like any other kind of insurance or safety requirement; it seems unnecessary until somebody checks or something bad happens.

They forewarn vendors about the regulations and that the Fire Marshal is on scene at this event, so better safe than sorry. Last year they stopped at my booth and asked if my lights were halogen. Thankfully, I was using LED bulbs.

They forewarn vendors about the regulations and that the Fire Marshal is on scene at this event, so better safe than sorry. Last year they stopped at my booth and asked if my lights were halogen. Thankfully, I was using LED bulbs.

At several shows, I’ve often heard some vendors express relief at getting just enough sales to cover their booth cost. But that’s only a small part of the expense of an event like this.

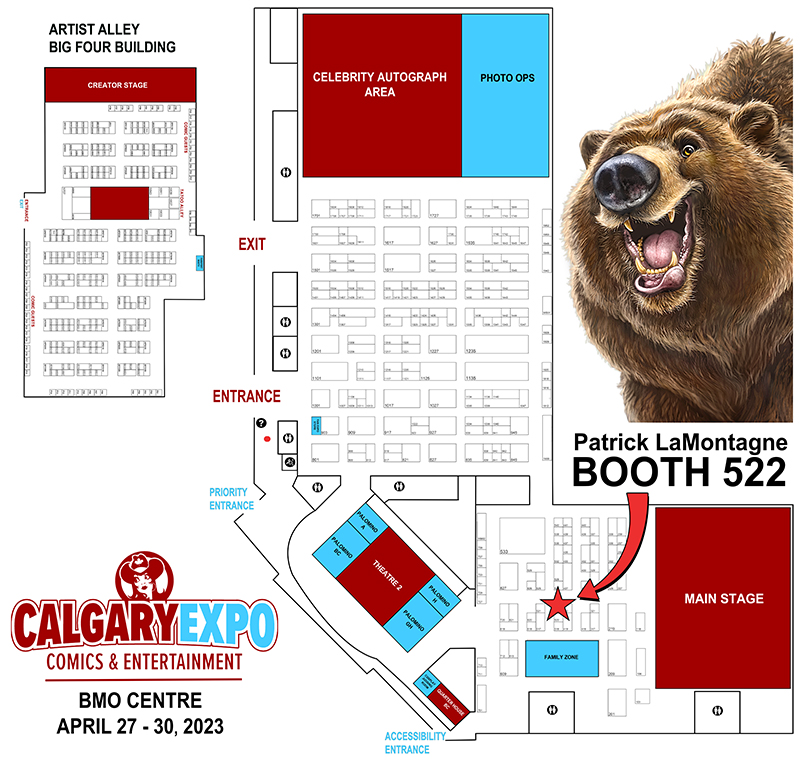

The Calgary Expo sees 90,000 people over four days; it’s a big show with over 800 exhibitors. My corner retail booth costs over $1200. Electrical power is $135.00, parking for five days is $66, and my hotel for four nights is over $600.00.

Liability and booth insurance for this one event is $88. I write my mileage off over the year, so I don’t consider gas in my show expenses, but depending on whether you bring your food or eat at restaurants, that can add up.

My equipment and display hardware are multiple-year expenses, so I don’t calculate that per show. But even before I stock the booth with stickers, magnets, coasters, prints, puzzles, aluminum, canvas and metal prints, my corner retail booth in the Exhibition Hall at the Calgary Expo costs over $2100. I don’t make any money at this show until I’ve sold that much.

Even then, every item I sell has a cost. Professional printing, cellophane sleeves, backer boards, artist bios and shipping are deducted from each print sale before there is a profit—the same for other products.

But a show like this one is well worth the investment.

“What’s new this year?” is something I hear a lot at Expo.

I’m always painting new images, so I invite people to scan the walls and flip through the bins because that’s the best way to discover the latest pieces, and sometimes they’ll find one they didn’t see last time.

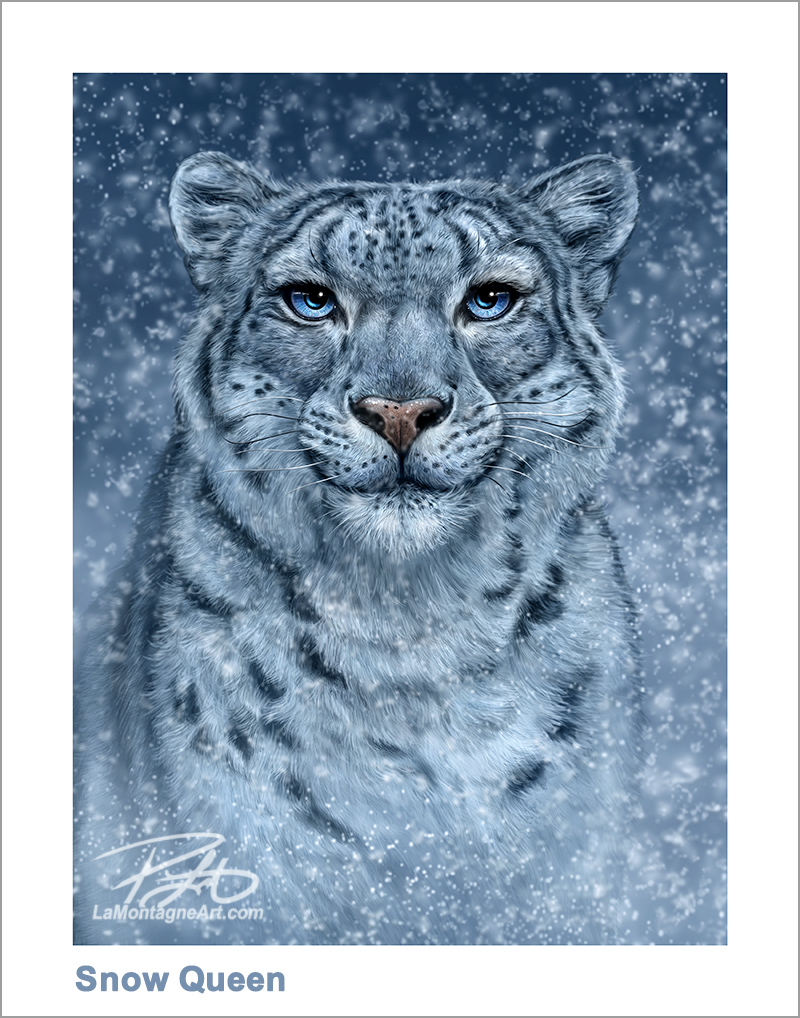

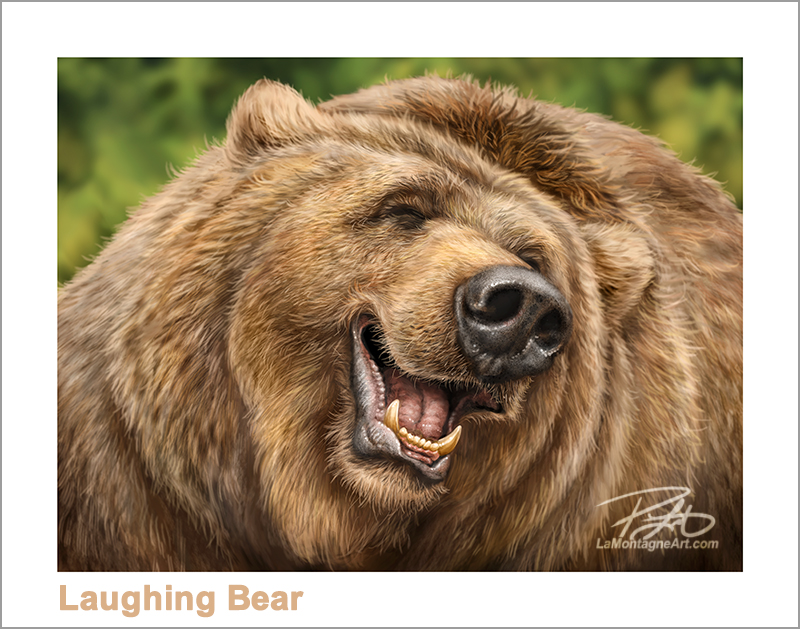

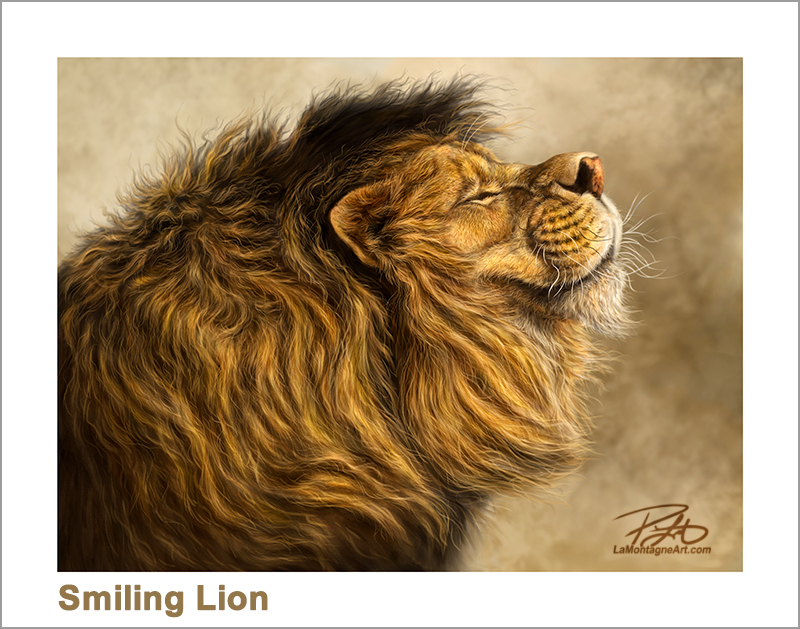

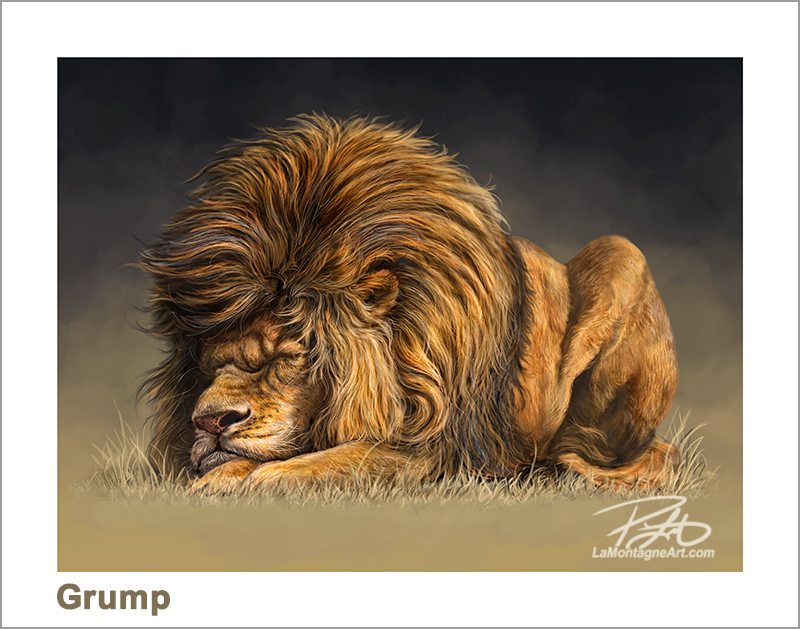

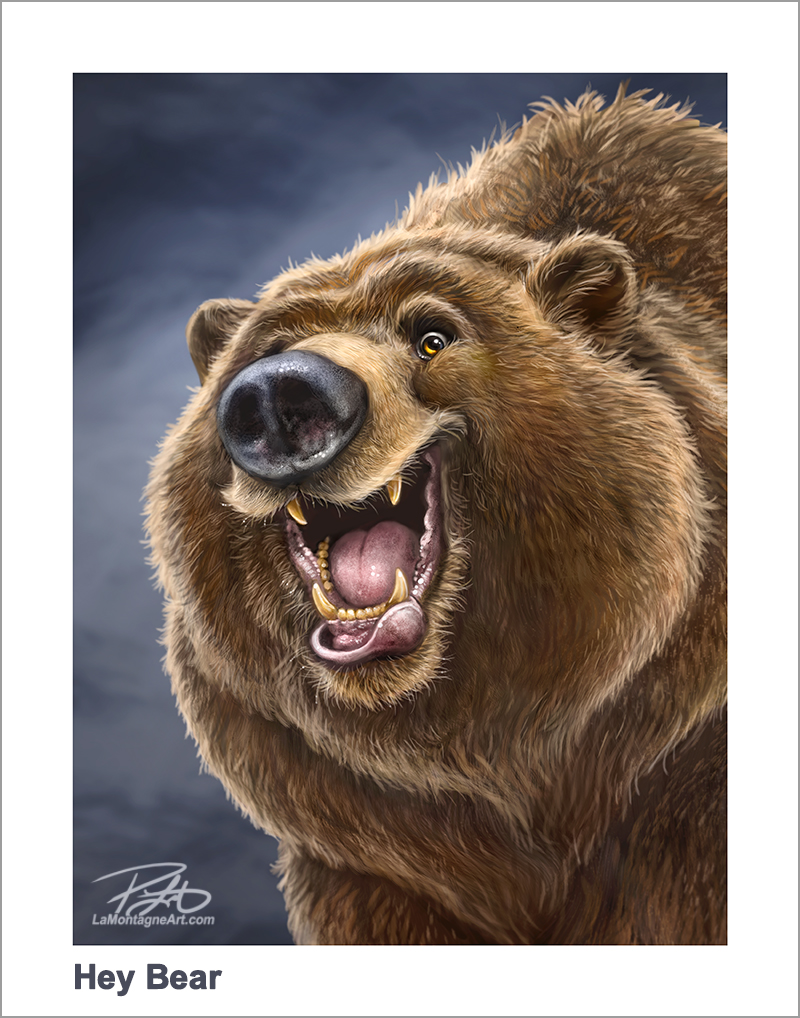

But with quite a few new poster prints this year, here they are. They’re each hand-signed, and 11”X14” which includes the white border. It’s an easy to find size at most stores that sell frames. The title, website and signature stamp are not on the actual print. The following paintings were not available at last year’s Expo.

While the Tarantula and Angry Bear might not appeal to everybody, I ordered those prints specifically for this event. If there’s an audience for these paintings, it will be at The Calgary Expo. I’m looking forward to the reaction, as I like both pieces.

For many of my paintings, it takes some settling time after I complete them before I know if I really like them. Of these most recent paintings, I realized that Bugle Boy, my painting of a bull elk, might be a personal favourite. I don’t know if it’s the texture I painted in his rack, the personality or the colour, but I loved seeing this piece in print, and I hadn’t expected that.

For many of my paintings, it takes some settling time after I complete them before I know if I really like them. Of these most recent paintings, I realized that Bugle Boy, my painting of a bull elk, might be a personal favourite. I don’t know if it’s the texture I painted in his rack, the personality or the colour, but I loved seeing this piece in print, and I hadn’t expected that.

It’ll be interesting to see if it resonates with anybody else.

I’ve only got a few canvas prints this year, but a couple of dozen matte metal in 12”X16” and 18”X24”. Because I already had a nice selection of those in my inventory, I only ordered five new ones on 12”X16” metal. I can, however, custom order any of my paintings on metal or canvas at any time, in a variety of sizes.

I’m a much better painter than photographer, so the print colour, clarity and detail are always much better in person than in photos. Here are the new 12″X16″ metal prints, ready to hang.

Many people buy four-day passes for this show, but others come for only one day. Saturday is the leader when it comes to crowd volume and sales. All four days are usually good, but I’m trying out some daily specials for the other three this year.

Many people buy four-day passes for this show, but others come for only one day. Saturday is the leader when it comes to crowd volume and sales. All four days are usually good, but I’m trying out some daily specials for the other three this year.

DAILY SPECIALS

Thursday: A free high-quality vinyl sticker with every print purchase.

Friday: $20 OFF any matte metal or canvas print.

Sunday: A free gift with purchase of $25 or more.

Of course, if you’re a repeat customer, you can mention any of these specials on any day of the show, and I’ll happily reward your loyalty.

If you’ve been in my booth before, there’s an excellent chance I’ll remember you. I’m great with faces but not so much with names. So please stop by and say Hello, and (re)introduce yourself, especially if you’re a subscriber to A Wilder View and we’ve never met. I always love to say Thank You in person.

Cheers,

Patrick

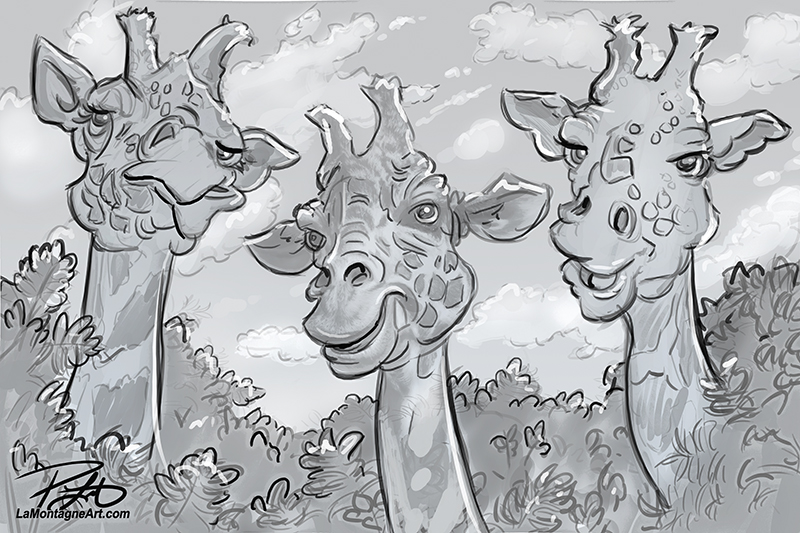

The challenge with this piece is to make each character different from the others but with the same level of detail and colour palette.

The challenge with this piece is to make each character different from the others but with the same level of detail and colour palette.

If you’ve followed my work for a long time (hey, thank you!), you’ll know how much I look forward to the

If you’ve followed my work for a long time (hey, thank you!), you’ll know how much I look forward to the

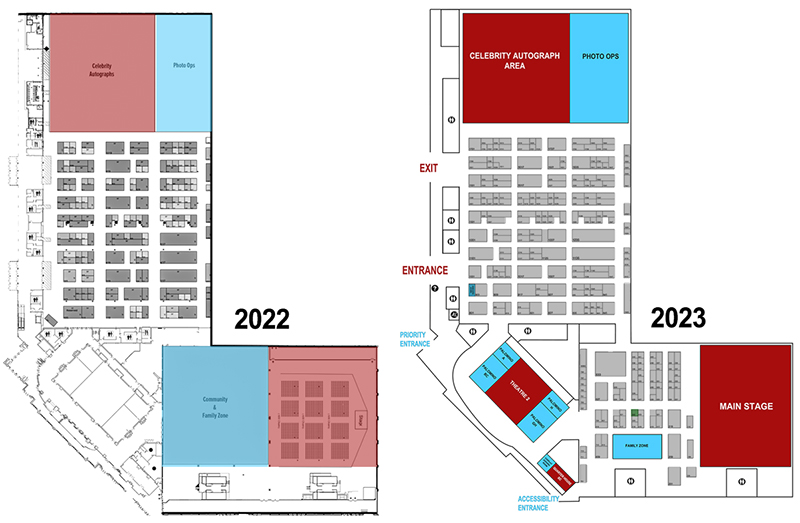

I redesigned my booth last year and it worked so well for me, that I’m making no changes, except that I have invested in new lighting this year. As there was a pillar behind me, rather than another booth, I was able to expand a couple of feet. But I’ve got vendors right up against me on both sides this year, so I’ll have to stick to my 10’x10’ footprint.

I redesigned my booth last year and it worked so well for me, that I’m making no changes, except that I have invested in new lighting this year. As there was a pillar behind me, rather than another booth, I was able to expand a couple of feet. But I’ve got vendors right up against me on both sides this year, so I’ll have to stick to my 10’x10’ footprint.

In 2008, I hosted the Canadian Editorial Cartoonists Conference in Banff. Several industry veterans who attended came up in a culture where busy unionized daily newspapers hired editorial cartoonists for impressive salaries, benefits, and pensions. I began my career at the end of all that.

In 2008, I hosted the Canadian Editorial Cartoonists Conference in Banff. Several industry veterans who attended came up in a culture where busy unionized daily newspapers hired editorial cartoonists for impressive salaries, benefits, and pensions. I began my career at the end of all that.

Eventually, social media killed the forum, and the organization rebranded. As a result, NAPP no longer exists, and the Photoshop World conference is a ghost of its former self.

Eventually, social media killed the forum, and the organization rebranded. As a result, NAPP no longer exists, and the Photoshop World conference is a ghost of its former self. I’ve taken a new approach with the trio of giraffes, already titled “Long Neck Buds.” I don’t know if it will work the way I imagine it, but if it does, it will be the first of several I plan to paint this way.

I’ve taken a new approach with the trio of giraffes, already titled “Long Neck Buds.” I don’t know if it will work the way I imagine it, but if it does, it will be the first of several I plan to paint this way. I’m a commercial artist, it’s how I make my living. I don’t pretend otherwise. But this is also supposed to be fun. I want to paint more detailed and elaborate images I’ll enjoy while also leaving options open for clients and licenses with different needs.

I’m a commercial artist, it’s how I make my living. I don’t pretend otherwise. But this is also supposed to be fun. I want to paint more detailed and elaborate images I’ll enjoy while also leaving options open for clients and licenses with different needs.

One evening when Shonna and I were first dating, we watched the fun comedy horror movie Arachnophobia with her mom and stepfather. The movie over, I sat in front of the TV to rewind and remove the rented VHS tape. Yes, it was a long, long time ago.

One evening when Shonna and I were first dating, we watched the fun comedy horror movie Arachnophobia with her mom and stepfather. The movie over, I sat in front of the TV to rewind and remove the rented VHS tape. Yes, it was a long, long time ago. Derek took some photos for me, and I’ve wanted to paint this tarantula ever since, though I doubt it will be a popular print. I just wanted to try it.

Derek took some photos for me, and I’ve wanted to paint this tarantula ever since, though I doubt it will be a popular print. I just wanted to try it. And yet, the natural features below his eyes suggested a moustache and maybe the illusion of a mouth. Humans are geared to see patterns. It’s called

And yet, the natural features below his eyes suggested a moustache and maybe the illusion of a mouth. Humans are geared to see patterns. It’s called

My first puzzle order from the manufacturer was bigger than planned because I sold more in the preorder than expected.

My first puzzle order from the manufacturer was bigger than planned because I sold more in the preorder than expected. This whole experience was a lot of fun. First, Shonna and I enjoyed assembling the test puzzle over the holidays. Then, polling my subscribers to vote for their favourites so I could choose my first four puzzle designs worked out great. Then there was the back and forth with the manufacturer to finalize the design, and each new rendering was a gift.

This whole experience was a lot of fun. First, Shonna and I enjoyed assembling the test puzzle over the holidays. Then, polling my subscribers to vote for their favourites so I could choose my first four puzzle designs worked out great. Then there was the back and forth with the manufacturer to finalize the design, and each new rendering was a gift. Though I won’t be assembling another one myself right now, feel free to share your own fun with me. I would love to see your puzzles in progress and hear your feedback.

Though I won’t be assembling another one myself right now, feel free to share your own fun with me. I would love to see your puzzles in progress and hear your feedback.

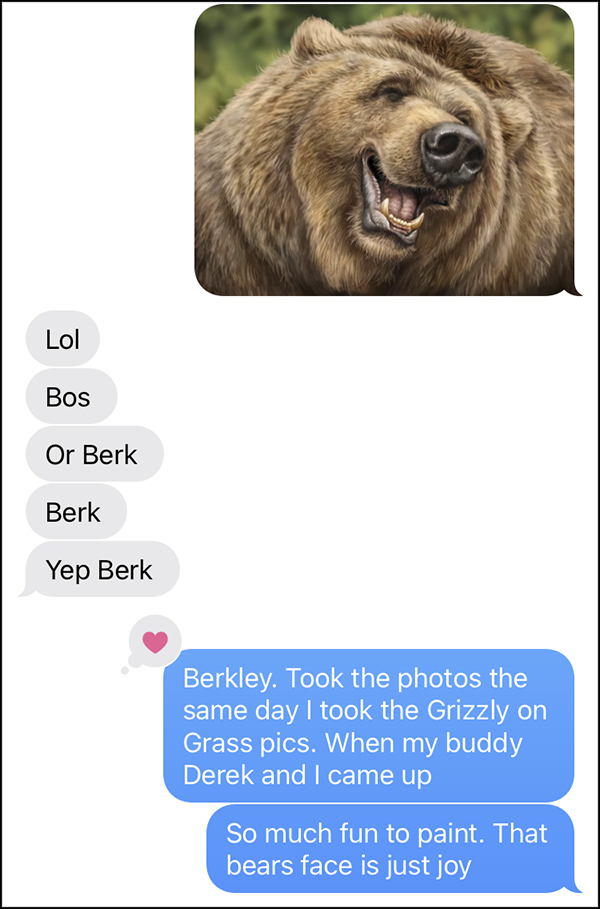

I’ve lost track of how many animals I’ve painted since that first grizzly bear in 2009, but I know it’s more than a hundred.

I’ve lost track of how many animals I’ve painted since that first grizzly bear in 2009, but I know it’s more than a hundred. If you’ve followed my work for longer than five minutes, you’ll know all about her. An orphan rescued from the US in 2017 by my friend Serena at Discovery Wildlife Park in Innisfail, I’ve known Berkley since she was a few months old and have been painting her ever since. Here’s the first one.

If you’ve followed my work for longer than five minutes, you’ll know all about her. An orphan rescued from the US in 2017 by my friend Serena at Discovery Wildlife Park in Innisfail, I’ve known Berkley since she was a few months old and have been painting her ever since. Here’s the first one.

Serena regularly sends Shonna and I texts and photos of the animals, and we visit Discovery Wildlife Park as often as possible. Not so much the past few years, for obvious reasons, but I intend to change that once the warmer weather arrives.

Serena regularly sends Shonna and I texts and photos of the animals, and we visit Discovery Wildlife Park as often as possible. Not so much the past few years, for obvious reasons, but I intend to change that once the warmer weather arrives. It’s a wonderful feeling that Berkley still knows me each visit and comes to say hello, no matter where she is in her large enclosure.

It’s a wonderful feeling that Berkley still knows me each visit and comes to say hello, no matter where she is in her large enclosure.

Whenever I’ve gone to Ucluelet on Vancouver Island, I’ve walked down a large staircase to the government dock to take photos of sea lions. To locals, they’re unremarkable, even a nuisance. While I’m happily snapping photos, those working on the nearby fishing boats are likely rolling their eyes at this silly tourist.

Whenever I’ve gone to Ucluelet on Vancouver Island, I’ve walked down a large staircase to the government dock to take photos of sea lions. To locals, they’re unremarkable, even a nuisance. While I’m happily snapping photos, those working on the nearby fishing boats are likely rolling their eyes at this silly tourist.

Just yesterday, I received the 3D preview renderings, the Otter you see here. As it’s been challenging for anybody who ships anything lately, I’ll be double-checking with Canada Post today to get the best shipping price I can, and preparing the preorder to launch on Monday, February 13th.

Just yesterday, I received the 3D preview renderings, the Otter you see here. As it’s been challenging for anybody who ships anything lately, I’ll be double-checking with Canada Post today to get the best shipping price I can, and preparing the preorder to launch on Monday, February 13th. This preorder will be exclusive to

This preorder will be exclusive to